Rounding off of a fraction of a rupee in regulation of additional pension -Pensioner Portal Order

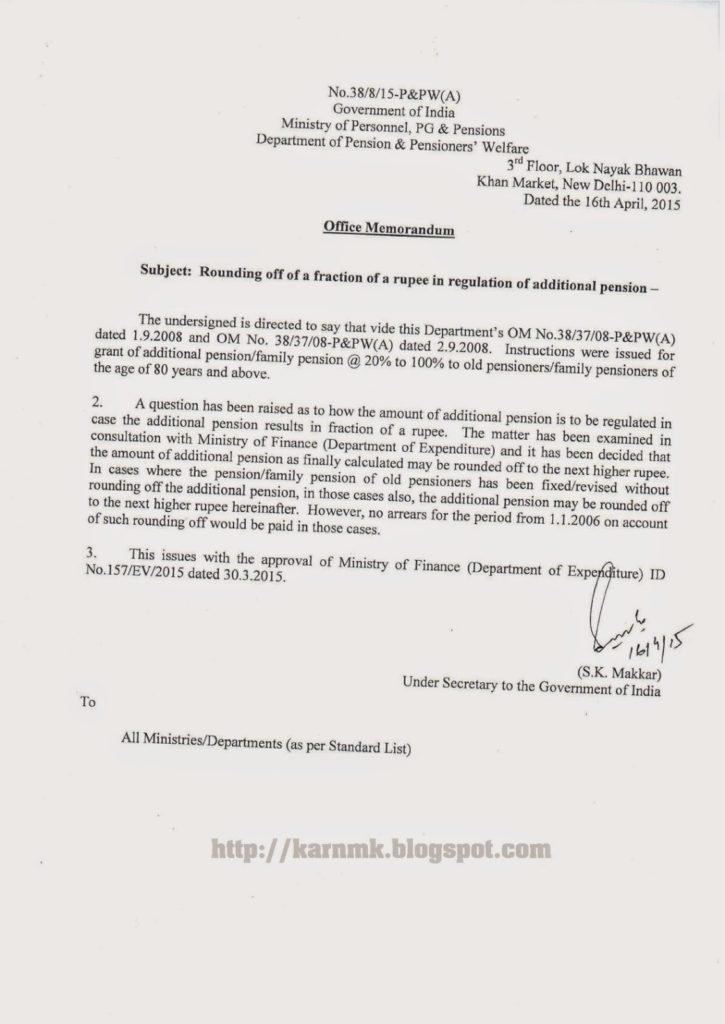

No.38/8/15-P&PW(A)

Government of India

Ministry of Personnel, PG & Pensions

Department of Pension & Pensioners’ Welfare

3rd Floor, Lok Nayak Bhawan

Khan Market, New Delhi-110 003.

Dated the 16th April, 2015

Office Memorandum

Subject: Rounding off of a fraction of a rupee in regulation of additional pension –

The undersigned is directed to say that vide this Department’s OM No.38/37/08-P&PW(A) dated 1.9.2008 and OM No.38/37/08-P&PW(A) dated 2.9.2008. Instructions were issued for grant of additional pension/family pension @ 20% to 100% pensioners/family pensioners of the age of 80 years and above.

2. A question has been raised as to how the amount of additional pension is to be regulated in case the additional pension results in fraction of a rupee. The matter has been examined in consultation with Ministry of Finance (Department of Expenditure) and it has been decided that the amount of additional pension as finally calculated may be rounded off to the next higher rupee. In cases where the pension/family pension of old pensioners has been fixed/revised without rounding off the additional pension, in those cases also, the additional pension may be rounded off to the next higher rupee hereinafter. However, no arrears for the period from 1.1.2006 on account of such rounding off would be paid in those cases.

3. This issues with the approval of Ministry of Finance (Department of Expenditure) ID No.157/EV/2015 dated 30.3.2015.

(S.K. Makkar)

Under Secretary to the Government of India

Source:http://documents.doptcirculars.nic.in/D3/D03ppw/Roundingofffraction.pdf

|

| [Download this image for reference] |

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Veteran air warrior, joined I.A.F.May1965,discharged July1974 -"On Completion Of Regular Service.During my discharge, was in Lower Medical Category -"CEE", and Finally awarded Life Time Category CEE, 20% Disability Pension."Service Element/Pension of Disability Pension" is Not applicable to me,that's what I have been told.

In view of above,Kindly let me know – How much benefit/s I may expect from OROP and 7CPC ? My 20% Dis. Pension is Rs.1400/= (RS.One thousand Four Hundred Only).

CPL, Swaraj Kumar Mukerji, Flt.Mech.Air Frame, Ser. No: 265853. Email : [email protected]