Decrease in Take Home Salary from 6th to 7th Pay Commission – IRTSA

7th CPC PAY HIKE – IS IT A HIKE OR A FARCE ?

THE CAUSE IS HIDDEN

THE EFFECT IS VISIBLE TO ALL

7th CPC has submitted its report to the Government and the additional expenditure projected by the PAY Commission is of 1.02 lakh rupees. As outsiders many of the country men started crying hoarse that the Govt. employees are taking away lions’ share of its income.

Out of the projected 1.02 lakh hike, just above 1/4th is going to be borne by Indian Railways within its own budget; centre has to bear 1/4th towards pension, 1/4th towards allowances and only 1/4th towards Pay. Govt. need to borne only Rs.27,750 crores towards increase in pay. Allowances need not be taken as higher expenditure since they are part of compensation towards inflation and expenditure incurred in discharge of official duties.

7th CPC itself observed that financial impact on account of increase in pay, allowances & pension will be 23.55%. Increase on account of Pay & DA (excluding other allowances) will be to the tune of 16%. At present, without implementing 7th CPC Report, Year on year increase in the expenditure in both pay and pension has averaged about 11% of the Central Expenditure. Thus real increase on account of increase in pay, all allowances & pension will be only 12.55% (23.55% – 11% = 12.55%). Real increase on account of Pay & DA will be only 5% (16% – 11% = 5%).

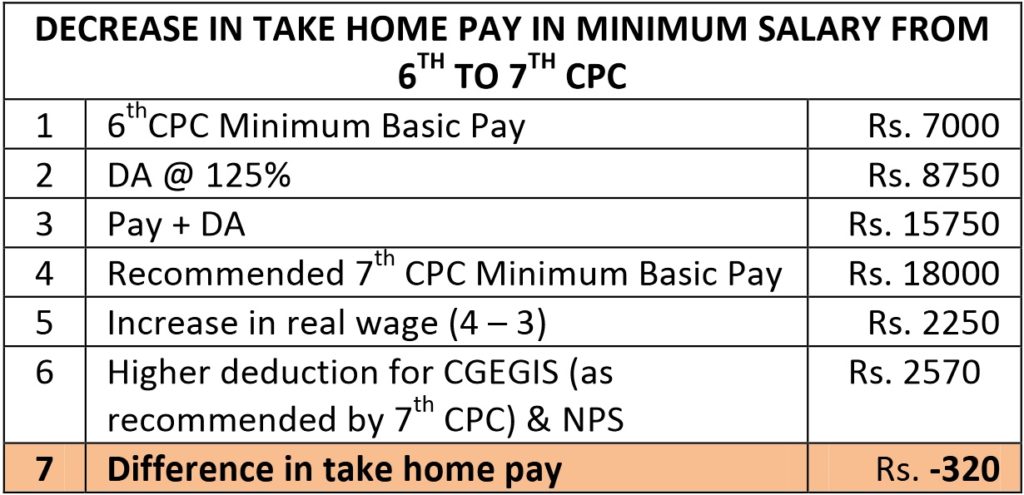

IS THERE A REAL INCREASE IN TAKE HOME PAY?

Real increase in minimum wage between 6th CPC & recommended 7th CPC scales will be Rs.2250. Employees’ contribution to National Pension scheme will increase from Rs.700 to Rs.1800 and for CGEGIS it will increase from present Rs.30 to Rs.1500. Therefore increase in real wage (take home pay) of Rs.2250 will be eaten away by Rs.900 increased contribution for NPS plus Rs.1500 for CGEGIS. Net take home pay will have a negative growth of Rs.320 (Rs.1100 + Rs.1470 – Rs.2250 = Rs. – 320) as illustrated in the table below:

WILL THERE BE ANY ADDITIONAL EXPENDITURE DUE TO PAY HIKE RECOMMENDED BY 7TH CPC?

Government will take back into its treasury Rs. 6500 crores from increased monthly contribution towards CGEGIS and another Rs.2500 crores towards employees’ contribution for NPS from 11 lakh employees appointed after 1.1.2004. After reducing Rs.9000 crore from Rs.27,750 crore (projected increase in pay), net additional expense towards Pay will be around Rs.18,750 crores only. Even this additional expenditure is not true.

Total Expenditure on Pay & Allowance in FY 2012- 13 was Rs.1,29,599 crore. If it is indexed by 11% increase year on year, in the FY 2015-16 even without implementing 7th CPC recommendations increase on account of Pay & Allowances will be around Rs.19,500 crore. Therefore Government is not going to have any additional expenditure on account of Pay increase after the implementation of 7th CPC Report as per its recommendations.

For 2012-13, revenues foregone through various concessions to various sections are estimated at a total of Rs.5,73,627 crore which was 10 per cent higher than the total fiscal deficit of the Central Government, financial experts say, concessions must be given to have accelerated economic growth. Government employees are exposed to negative growth in their real wage – but who cares?

Source: http://www.irtsa.net/pdfdocs/Editorial_VRE_Sept-Dec-2015.pdf

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS