Link your Aadhaar with PAN through just an SMS

Now you can link your Aadhaar with PAN using just an SMS. Your mobile number and e-mail id will help you receive alerts related to your Aadhaar and to access Aadhaar services easily. The Income Tax Department on Wednesday issued advertisements and described how both the unique identity numbers of an individual can be linked by sending an SMS to either 567678 or 56161.

Here is how you can use the SMS facility to link Aadhaar with PANSend SMS to 567678 or 56161 in following format:UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN>

Example:UIDPAN 111133333321 AAAAAEEEEE

It said people can also visit the official e-filing website of the department to link the two identities, in both the cases– identical names in the two databases or in case where there is a minor mismatch.

Your key to seamlessly avail online,

a world of Income Tax facilities!

Link your Aadhaar with your PAN; pic.twitter.com/zpOAuZidoN— Income Tax India (@IncomeTaxIndia) May 31, 2017

It said linking the two numbers is the key to “seamlessly avail online, a world of income tax facilities.”

“Aadhaar can also be seeded into PAN database by quoting Aadhaar in PAN application form for new PAN allotment or by quoting Aadhaar in change request form used for reprint of PAN card,” it said in the advertisement.

Why is it important to link Aadhaar with PAN?

The Income Tax Department is urging taxpayers to link their Aadhaar with their PAN, using an SMS-based facility because from July 1, 2017, all tax returns will have to mention the Aadhaar number.

If you have both the permanent account number (PAN) and Aadhaar, you need to link the two. If you fail to do so, your PAN number could become invalid.

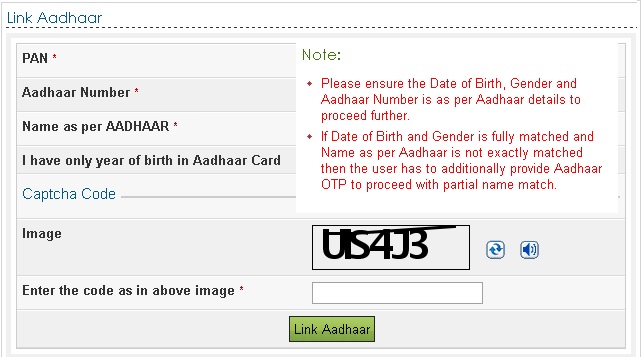

How to link your Aadhaar to PAN online:

1. Log on to incometaxindiaefiling.gov.in. (This step is not compulsory. You can directly jump to Step 2, if you do not wish to log in)

2. Click on ‘Link Aadhaar’

3. A pop up window will appear. Enter your Aadhaar number, PAN number and name as per Aadhaar

4. Enter captcha and click on ‘Link Aadhaar’.

In case of any minor mismatch in Aadhaar name provided, Aadhaar OTP (one-time password) will be required. The OTP will be sent on the registered mobile number in the Aadhaar database.

Linking mobile number with Aadhaar

You need to do this offline.

—Visit your nearest Aadhaar centre to get the Aadhar Update/Correction Form or download it from the UIDAI website.

— Fill out the form correctly; submit it to the concerned person at the centre and mention on the form that only mobile number is to be updated.

— While submitting the update form, along with photocopy of your Aadhaar card you also need to provide photocopy of an Identity proof document such as PAN Card, Passport, Voter ID card

— Following the submission, your biometrics will be verified at the enrolment centre. Your thumb impression will be verified. While applying for Aadhaar your biometrics were recorded and to authenticate the changes, they are verified.

— After verifying the biometrics, you will be given an acknowledgement slip. Usually, it takes 2-5 working days for the update to happen but as per the UIDAI helpline, the turnaround time for the update is 10 days.

The government, under the Finance Act 2017, has made it mandatory for taxpayers to quote Aadhaar or enrolment ID of Aadhaar application form for filing of Income-Tax returns (ITR).

While Aadhaar is issued by the UIDAI to a resident of India, PAN is a ten-digit alphanumeric number issued in the form of a laminated card by the I-T department to any person, firm or entity.

Source: Business-standard

COMMENTS